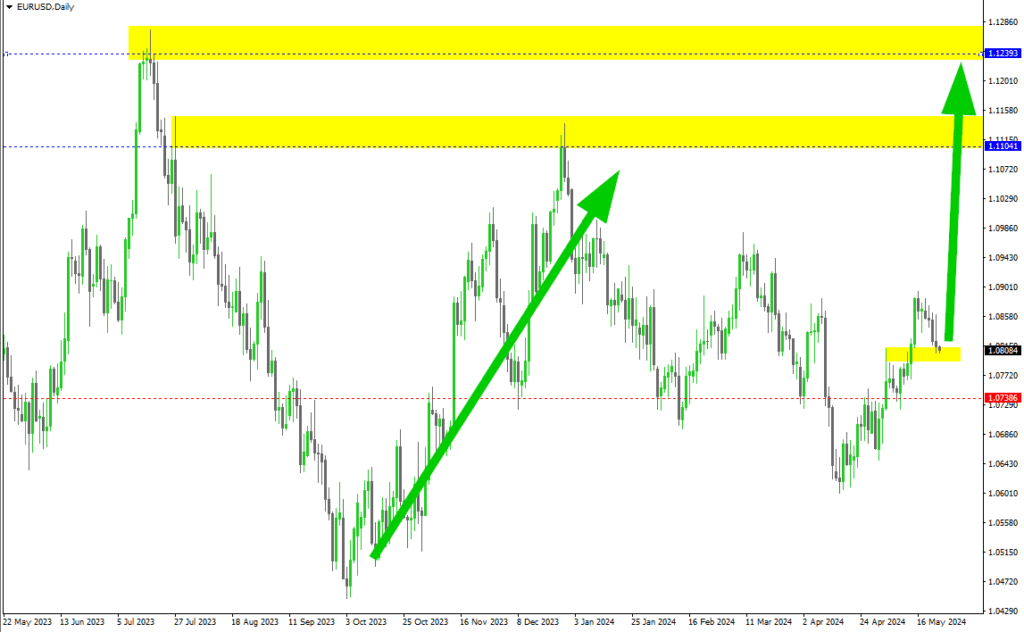

Welcome, fellow traders! Today, we’ll dive into a detailed analysis of a compelling bullish breakout setup on the EUR/USD daily chart. From May 2023 to May 2024, this setup presents a perfect opportunity to apply our primary trading strategies: Trading Breakout using the ‘2 Hill 2 Valley’ technique and Support and Resistance levels. Let’s explore the potential of this chart in detail!

Key Support and Resistance Levels

The chart shows a well-defined support level around 1.07386, marked by the red horizontal line. This level has been tested several times and held strong, confirming its importance. The resistance levels are highlighted with yellow horizontal bars, with the first resistance at 1.11041 and the second one at 1.12393.

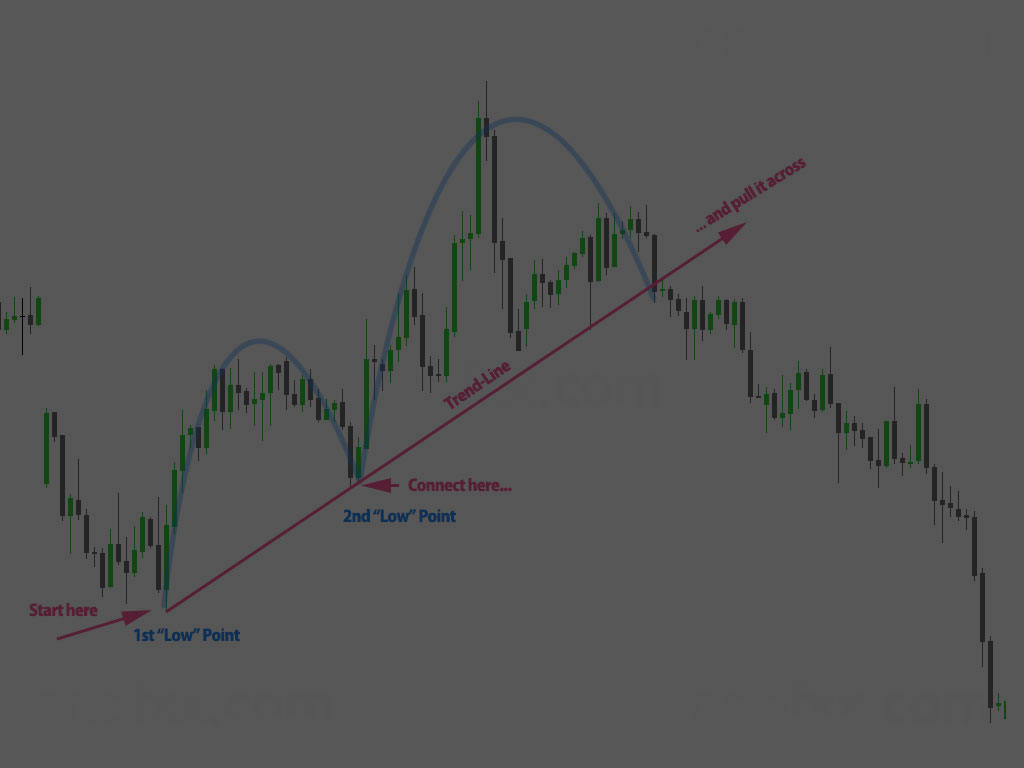

Strategy 1: Trading Breakout Using the ‘2 Hill 2 Valley’ Technique

The ‘2 Hill 2 Valley’ technique is a great way to identify potential breakout opportunities. Here’s how it’s applied to our chart:

- First Hill and Valley: The first hill was formed around early October 2023, peaking near the 1.06000 level. The price then retraced, forming the first valley around mid-October 2023.

- Second Hill and Valley: The second hill was established around the 1.07386 support level in late October 2023, followed by another retracement, creating the second valley in early November 2023.

This pattern indicated a potential breakout as the price consistently tested the support and resistance levels.

Strategy 2: Support and Resistance Levels

The yellow horizontal bars on the chart indicate the critical resistance levels:

- First Resistance Level (1.11041): This level was tested and broken around 16th December 2023, confirming the bullish breakout. The breakout was supported by strong upward momentum, indicating buyer dominance.

- Second Resistance Level (1.12393): This is our target resistance level. Following the breakout from the first resistance, the price moved towards this level, showcasing the potential for further upward movement.

Detailed Breakdown of the Bullish Move

Entry Point

Our ideal entry point was at the breakout above the first resistance level (1.11041) around mid-December 2023. This breakout was confirmed by a strong bullish candlestick, indicating a shift in market sentiment.

Stop-Loss

A conservative stop-loss can be placed below the previous support level, around 1.07386. Alternatively, for a tighter stop, you could set it just below the breakout candle’s low, ensuring minimal risk exposure.

Take Profit

Our first take profit target is at the second resistance level (1.12393), offering a substantial reward for the risk taken. Beyond this, we can trail our stop to lock in profits as the price moves higher.

Risk-to-Reward Ratio

Considering our entry at 1.11041 and stop-loss at 1.07386, the risk is approximately 87 pips. With a take profit at 1.12393, the reward is about 407 pips, giving us a risk-to-reward ratio of approximately 1:4.68. This ratio is highly favourable, aligning with our trading principles of ensuring higher rewards compared to risks.

Upcoming Market News Impacting EUR/USD

May 25, 2024: The Eurozone will release its Consumer Confidence data for May. A better-than-expected reading could boost the euro, potentially pushing EUR/USD higher. Conversely, a disappointing figure may weigh on the currency pair.

May 31, 2024: The U.S. will publish its Core Personal Consumption Expenditures (PCE) Price Index, a key inflation gauge closely watched by the Federal Reserve. A higher-than-expected reading could prompt more aggressive interest rate hikes, potentially strengthening the U.S. dollar and putting downward pressure on EUR/USD.

June 1, 2024: The Eurozone will release its Manufacturing PMI for May. A strong reading could signal robust economic growth in the region, potentially boosting the euro and supporting EUR/USD. Conversely, a weak figure may have the opposite effect.

Alternative Stop-Loss Management

For those preferring dynamic stop-loss management, consider trailing the stop based on recent swing lows. This method locks in profits while allowing the trade to breathe and capture more significant moves.

Practising with Forex Tester

To master these setups, I recommend practising risk-free with Forex Tester. This tool allows you to backtest strategies and build confidence before applying them in live markets.

Conclusion

This EUR/USD bullish breakout setup from May 2023 to May 2024 offers a comprehensive example of how to apply our primary strategies effectively. By identifying key support and resistance levels and using the ‘2 Hill 2 Valley’ technique, we can develop robust trading plans with favourable risk-to-reward ratios.

Remember, successful trading comes from consistent practice and analysis. Keep honing your skills and refining your strategies to stay ahead in the forex market.

Happy trading!

Shigeru