Greetings traders! Today, we are diving into a detailed analysis of a gold breakout sell setup using key technical strategies. Let’s dissect the two charts provided, explore the setup, and discuss the strategies we can employ for a profitable trade.

Chart Analysis: Understanding the Setup

Chart 1: H4 Time Frame

The first chart (H4 time frame) shows a clear uptrend starting around 30th April 2024. The price steadily climbs, creating higher highs and higher lows, adhering to the ascending trendline marked in blue.

Key points to note:

- Trendline Support: The blue trendline acted as support, guiding the price upward.

- Break of Trendline: On 22nd May 2024, we notice a bearish candlestick breaking below the trendline, indicating a potential bearish move.

- Confirmation Candlestick: The highlighted yellow candlestick is a confirmation of the breakout. This bearish engulfing pattern confirms the sellers’ strength.

Chart 2: Daily Time Frame

The daily time frame provides a broader perspective on the gold price movement.

Key observations:

- Support and Resistance Levels: The horizontal bars at 2284.50 and 2189.00 mark significant support zones. These levels have historically acted as price reaction points.

- Breakout Confirmation: The break below the ascending trendline on the daily chart aligns with the H4 chart’s breakout, providing additional confirmation.

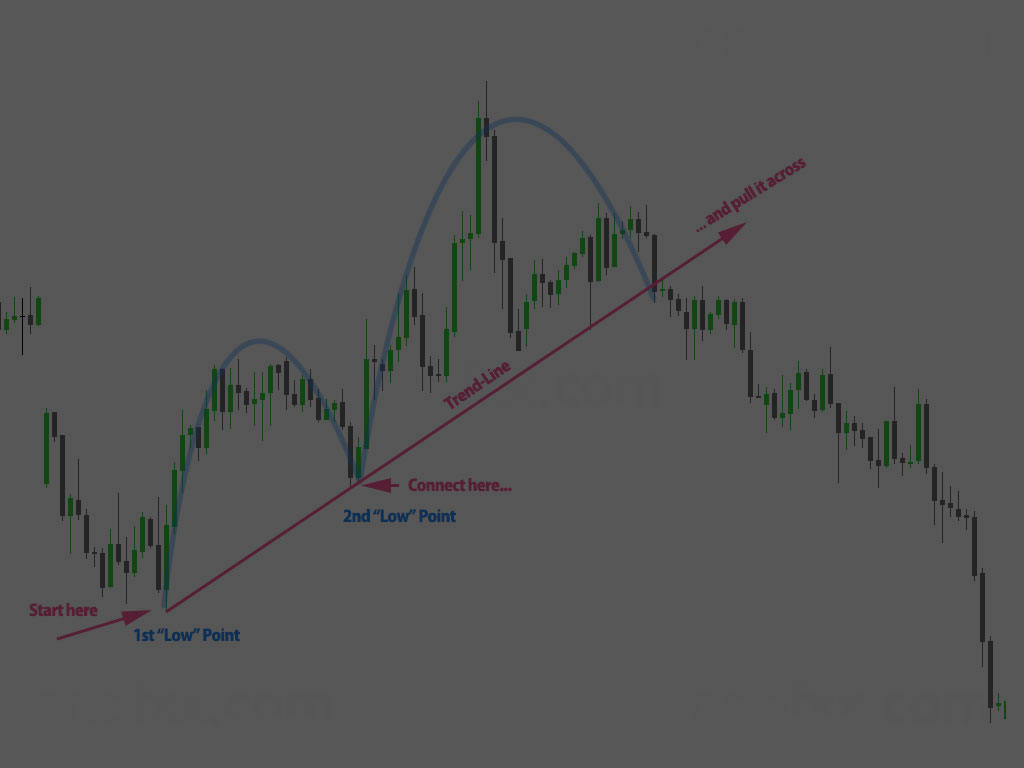

Strategy 1: Trading Breakout with ‘2 Hill 2 Valley’

Breakout Strategy: The ‘2 Hill 2 Valley’ technique is particularly useful here. This strategy consists of two higher highs (hills) and two higher lows (valleys).

- Entry Point: Enter the trade when the price closes below the trendline with a confirmation candlestick. In this case, the entry would be around 22nd May 2024.

- Stop Loss: Place the stop loss above the recent high, around 2407.55, ensuring a safe margin.

- Take Profit: Aim for the next significant support level at 2284.50 for the first target and 2189.00 for the second target.

Strategy 2: Fibonacci Retracement

In this particular analysis, the Fibonacci retracement is not applied, as no Fibonacci levels are drawn on the charts. However, it’s crucial to understand that Fibonacci retracement levels between 50% and 61.8% are typically key zones for potential reversals.

Strategy 3: Support and Resistance Levels

Support and Resistance Strategy: Identifying key support and resistance levels is essential in this setup.

- Entry Point: The initial breakout below the trendline provides the entry signal.

- Stop Loss: Place the stop loss slightly above the resistance level of 2407.55.

- Take Profit: The first take profit level is set at the support level of 2284.50. If the price continues to move down, the second take profit level is 2189.00.

Risk-to-Reward Ratio

Considering the entry and stop-loss levels, we calculate the risk-to-reward ratio:

- Risk: Entry at 2390.00 and stop loss at 2407.55. Risk per trade is 17.55 points.

- Reward: First take profit at 2284.50. Reward per trade is 105.50 points.

Risk-to-Reward Ratio: 105.50 / 17.55 ≈ 6:1

This high risk-to-reward ratio makes the setup quite attractive. However, always remember to manage your trades and adjust stop losses as the price moves in your favour.

Alternate Stop-Loss Management

- Trailing Stop Loss: Use a trailing stop loss to lock in profits as the price moves towards your take profit levels.

- Partial Profit Booking: Consider booking partial profits at the first support level and move the stop loss to breakeven to secure the trade.

Upcoming Market News Impacting Gold Futures (GCK24)

May 26, 2024: The U.S. will release its Core Personal Consumption Expenditures (PCE) Price Index, a key inflation gauge closely watched by the Federal Reserve. A higher-than-expected reading could prompt more aggressive interest rate hikes, potentially boosting the U.S. dollar and putting downward pressure on gold prices.

May 31, 2024: The U.S. Labor Department will publish the Employment Cost Index for the first quarter of 2024. This report measures the changes in the cost of labor, which can influence inflation expectations and, consequently, the demand for gold as an inflation hedge

.June 2, 2024: The Institute for Supply Management (ISM) will release its Manufacturing PMI for May 2024. A strong reading could signal robust economic growth, potentially reducing safe-haven demand for gold. Conversely, a weak figure may boost gold’s appeal as a safe-haven asset.

Practical Tips and Recommendations

- Practice with Forex Tester: Use Forex Tester to practice this setup risk-free. It’s a great way to gain confidence in your strategy.

- Monitor Economic Events: Gold prices are highly sensitive to economic events. Keep an eye on economic calendars for any news that could impact the price.

Conclusion

The gold breakout sell setup presents a promising opportunity for traders. We can potentially capture significant profits by combining the ‘2 Hill 2 Valley’ technique, support and resistance strategy, and careful trade management. Remember, practice and patience are key to mastering these strategies.

Happy Trading!

Shigeru

For more detailed strategies and examples, check out our Trading Breakout Strategy, Support and Resistance Strategy, and explore the resources available on Zetafxx.

Links:

- Trading Breakout Strategy: https://zetafxx.com/trading-breakout-strategy-12-examples-lessons-how-to/

- Support and Resistance Strategy: https://zetafxx.com/support-and-resistance-strategy/

- Forex Tester: https://bit.ly/forextester-zetafxx