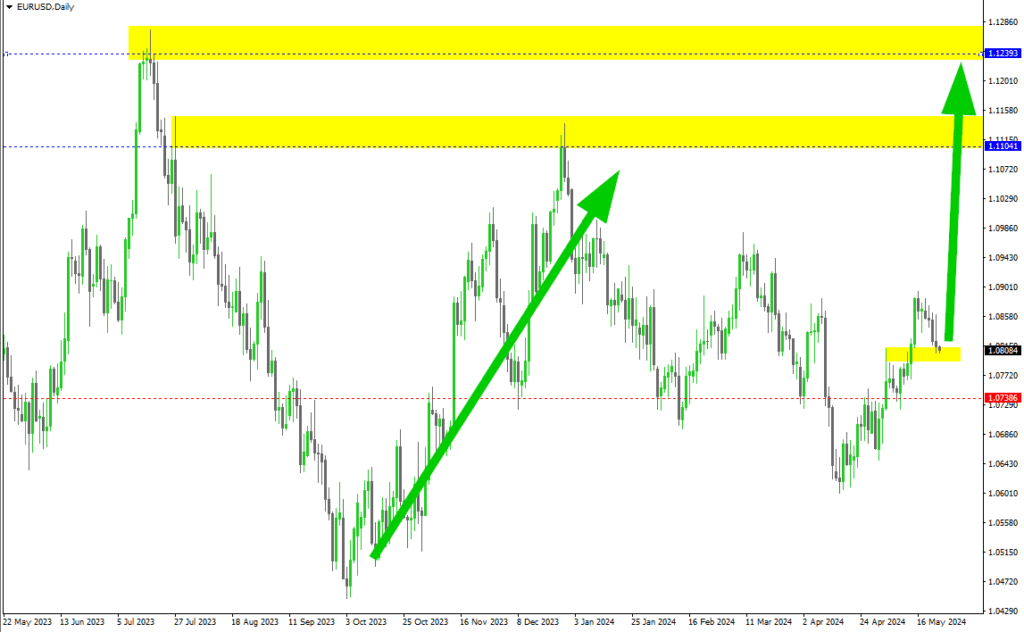

Welcome, fellow traders! Today, we’ll dive into a detailed analysis of a compelling bullish breakout setup on the EUR/USD daily chart. From May 2023 to May 2024, this setup presents a perfect opportunity to apply our primary trading strategies: Trading Breakout using the ‘2 Hill 2 Valley’ technique and Support and Resistance levels. Let’s explore […]

Category Archives: EUR/USD

Explore the fascinating world of the EUR/USD currency pair, not only the most traded pair in the forex market but also rich with interesting facts and trivia:

- Popularity and Liquidity: The EUR/USD is the most traded currency pair in the world, accounting for over 20% of daily forex trading volume. Its high liquidity ensures tight spreads and frequent trading opportunities.

- Economic Giants: The EUR/USD represents the economies of the Eurozone, which comprises 19 of the 27 European Union countries and the United States, the world’s largest economy. This pair is often seen as a barometer of global economic health.

- Historical Milestones: The euro was initially introduced on January 1, 1999, as an electronic currency. Physical euro banknotes and coins entered circulation on January 1, 2002. The EUR/USD pair has since been a key focus for traders worldwide.

- Volatility Factors: The EUR/USD exchange rate is influenced by various factors, including interest rate differentials set by the European Central Bank (ECB) and the Federal Reserve, political events, and economic data releases from both regions.

- Cultural Impact: The euro (€) symbol is inspired by the Greek letter epsilon (Є), which represents the cradle of European civilization and the first letter of “Europe.” The parallel lines signify stability.

- Economic Indicators: Key indicators affecting the EUR/USD pair include the US Non-Farm Payrolls (NFP) report, Eurozone GDP, US Federal Reserve interest rate decisions, and ECB monetary policy announcements.

- Historic Highs and Lows: The EUR/USD hit its all-time high of approximately 1.60 in July 2008, reflecting euro strength and dollar weakness during the global financial crisis. Conversely, it reached a historic low of around 0.82 in October 2000.

- Cross-Continental Influence: The EUR/USD pair is influenced by economic activities in both Europe and the US, so traders often need to monitor developments on both sides of the Atlantic, making it a truly global trading pair.

Whether you’re delving into the economic significance or enjoying the intriguing trivia, our “EUR/USD” category offers a comprehensive and engaging look into one of the forex market’s most vital currency pairs.