Hey there, fellow traders! 🌟

At ZetaFXX, we’re always on the lookout for promising trade setups, and today, we’ve got an exciting opportunity with GOLD on the horizon. If you’re as passionate about trading as we are, you’ll know that the market is full of opportunities just waiting to be seized.

Let’s dive into this potential GOLD trade setup that aligns perfectly with our strategic approach and trading principles.

Why this Gold Bearish Breakout Strategy Setup might work…

We’re eyeing a sell limit order at a key resistance level that’s caught our attention. The GOLD market has been showing some interesting movements, and we believe there’s a solid opportunity to capitalize on the current bearish trend.

Technical Analysis Breakdown

To give you a clearer picture, let’s break down the technical analysis further:

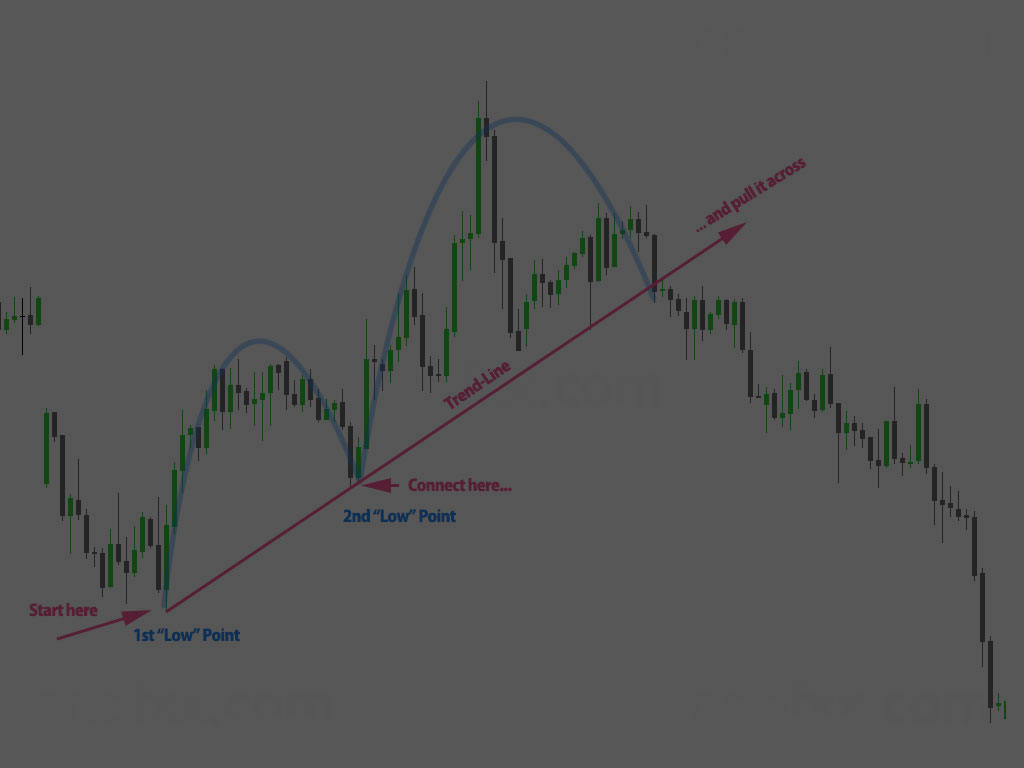

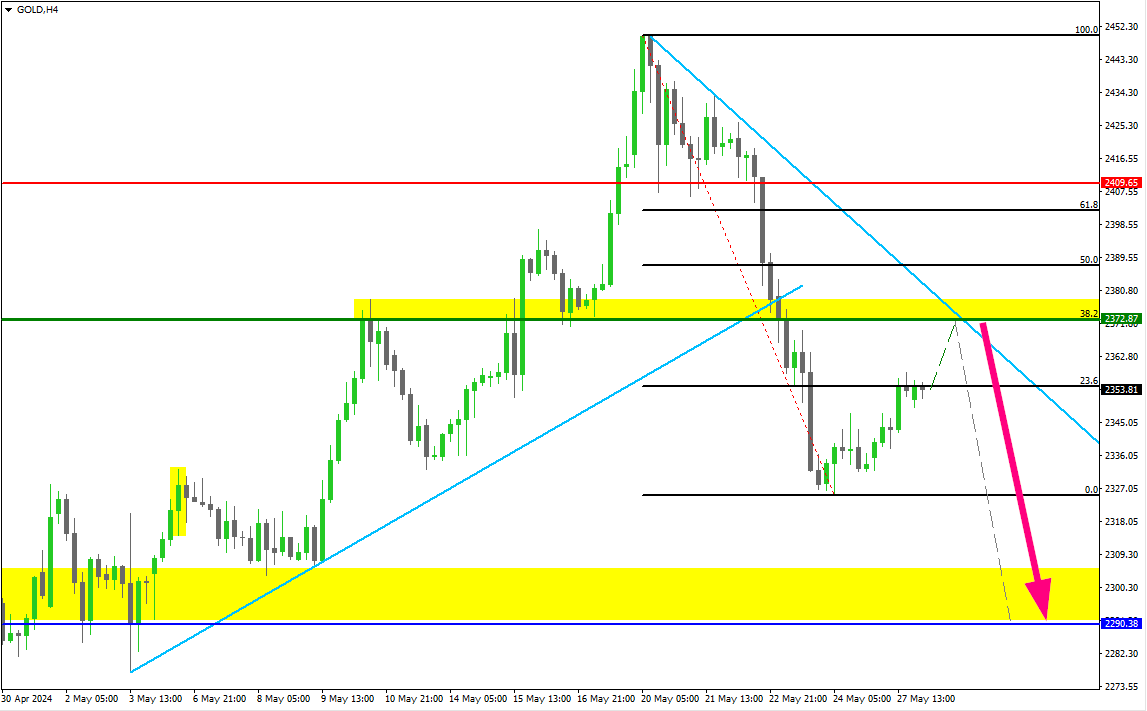

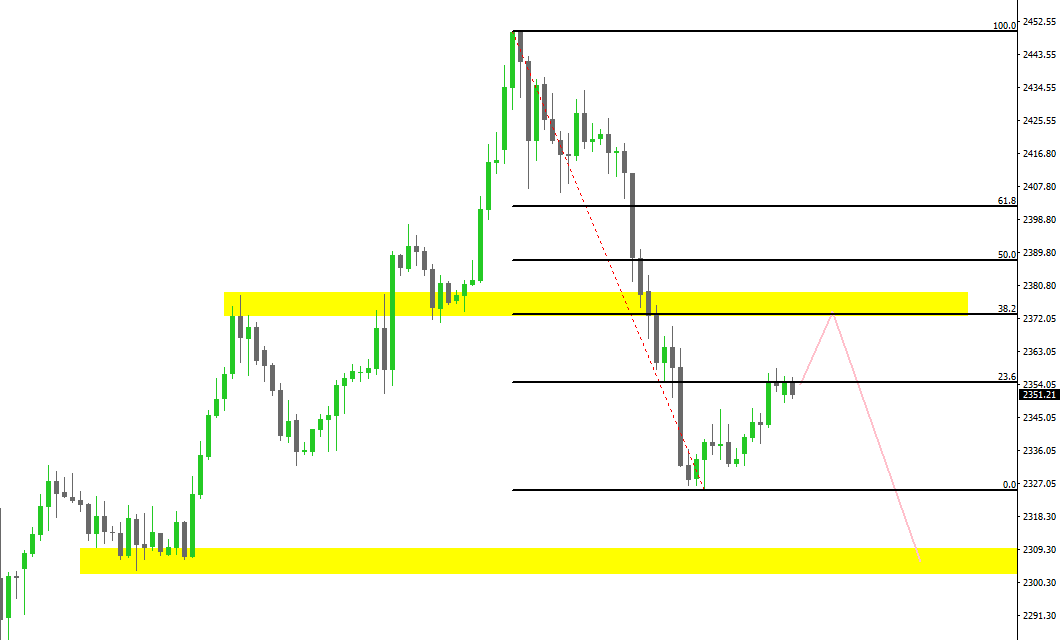

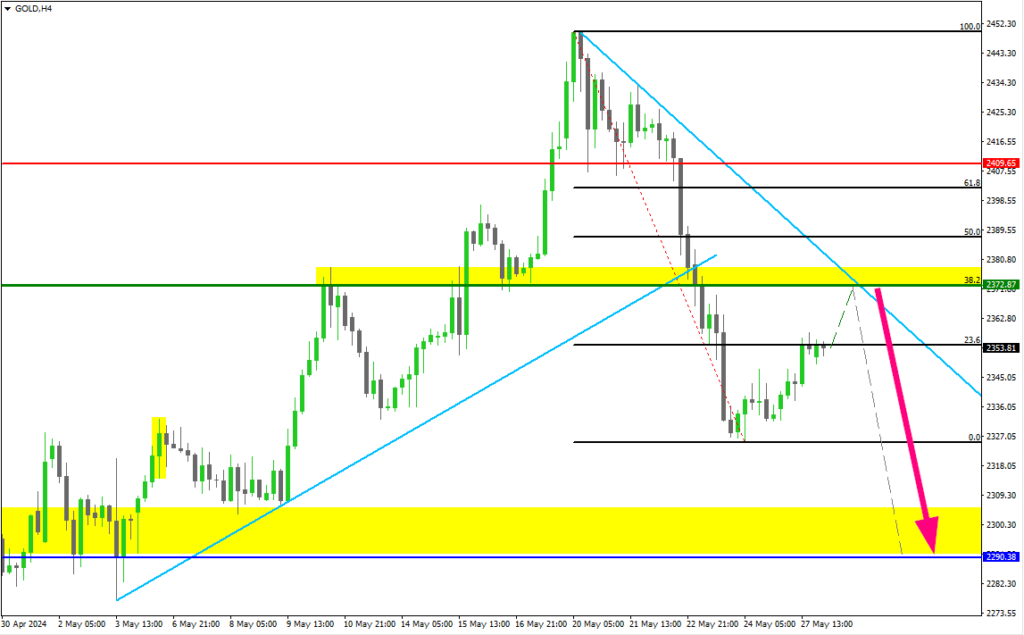

- Downward Trend Line: The trend line from the recent highs indicates a clear bearish momentum. Every time the price approached this trend line, it faced resistance and moved lower. This consistent behaviour gives us confidence that the trend line will continue to act as a resistance level.

- Fibonacci Retracement: The 38.2% retracement level from the recent swing high to the swing low aligns perfectly with our resistance zone. This confluence strengthens our resistance level, making it an ideal spot for placing our sell limit order. Learn more about trading with Fibonacci levels.

- Support and Resistance Zones: The yellow zones highlighted on the chart are critical areas where price has historically found support or resistance. These zones are derived from historical price action, where significant buying or selling activity has occurred. Learn more about identifying these zones in our Support and Resistance Strategy.

Trade Plan

- Sell Limit Order: We’ll place a sell limit order at 2372.87, right at the confluence of our key resistance indicators. (Green Line)

- Stop-Loss: To manage our risk effectively, we’ll set a stop-loss at 2409.65, just above the recent high and the 50% Fibonacci level. This placement gives our trade room to breathe while protecting us from significant losses. (Red Line)

- Take Profit: Our target is 2290.38, aiming for the support zone near the 0% Fibonacci level. This level has been identified as a strong support area, where price has previously found buying interest. (Blue Line)

Risk-to-Reward Ratio

This setup offers a fantastic risk-to-reward ratio of approximately 1:2.24. We can potentially gain 2.24 pips for every pip we risk, aligning perfectly with our trading philosophy of ensuring higher rewards than risks. A favourable risk-to-reward ratio is essential in maintaining profitability over the long term, as it ensures that our winning trades outweigh our losing ones.

Monitoring the Trade

As always, we’ll closely monitor the price action around our entry point. To confirm the resistance, we’ll look for bearish rejection signals like bearish engulfing patterns or doji candles. If the market shows strong bullish momentum breaking through our entry point, we’ll be ready to adjust or cancel the order to protect our capital.

Key Points to Watch

- Price Action Signals: Look for bearish candlestick patterns near our entry-level. These patterns include bearish engulfing candles, pin bars, and doji candles, which indicate potential reversals.

- Volume: Increased volume near the resistance level can signify strong selling interest, supporting our bearish outlook.

- Economic News: Monitor relevant economic news and events that could impact the price of GOLD. Significant news can cause volatility, which might affect our trade setup. Check the Forexfactory Economic Calendar for updates.

Trader Psychology and Risk Management

Trading isn’t just about technical analysis; it’s also about managing your mindset and risk. Here are some tips to help you stay disciplined:

- Stick to Your Plan: Once you’ve set your entry, stop-loss, and take profit levels, avoid the temptation to move them. Trust your analysis.

- Position Sizing: You should not risk more than a small percentage of your trading capital on this trade. Proper position sizing is critical to managing risk.

- Stay Informed: Stay updated with market news and updates that could impact GOLD prices. Being informed helps you make better trading decisions.

Conclusion

This potential GOLD trade setup is a great example of how we at ZetaFXX leverage technical analysis, confluence and market trends to identify high-probability opportunities. We’re excited about this setup and can’t wait to see how it unfolds. Remember, trading is all about patience, discipline, and strategy. Let’s make the most of this opportunity together!

At ZetaFXX, we aim to provide actionable insights and well-thought-out trading strategies. We believe that by sharing our analysis and thought process, we can help you become a more informed and successful trader. This GOLD trade setup is just one of many opportunities we identify and analyze daily.

Happy trading, and let’s stay ahead of the market!