〽️How to Master Fibonacci Retracement Trading Strategy with 12 great examples

Introduction

Hey there! Are you ready to dive into the fascinating world of Fibonacci trading? Whether you’re a budding trader or just curious about how numbers can influence the stock market, you’re in for an intriguing journey.

Fibonacci trading is not just about numbers; it’s about the magic and mystery surrounding them, influencing decisions in financial markets worldwide.

Learning Difficulty: 7/10

Table of contents

How is Fibonacci used in Trading?

Fibonacci trading uses a series of numbers discovered by Leonardo Fibonacci, an Italian mathematician. These aren’t just any numbers; they appear everywhere in nature, from the arrangement of leaves on a stem to the spirals of a seashell!

In trading, these numbers help predict where prices might go, acting as potential support or resistance levels on price charts.

The Magic Numbers

The main numbers used in Fibonacci trading are 23.6%, 38.2%, 50%, 61.8%, and 100%. These percentages are derived from the Fibonacci sequence, where each number is the sum of the two preceding ones. Cool, right? Traders use these percentages to find potential market turning points crucial for buying or selling decisions.

Setting Up Your Chart

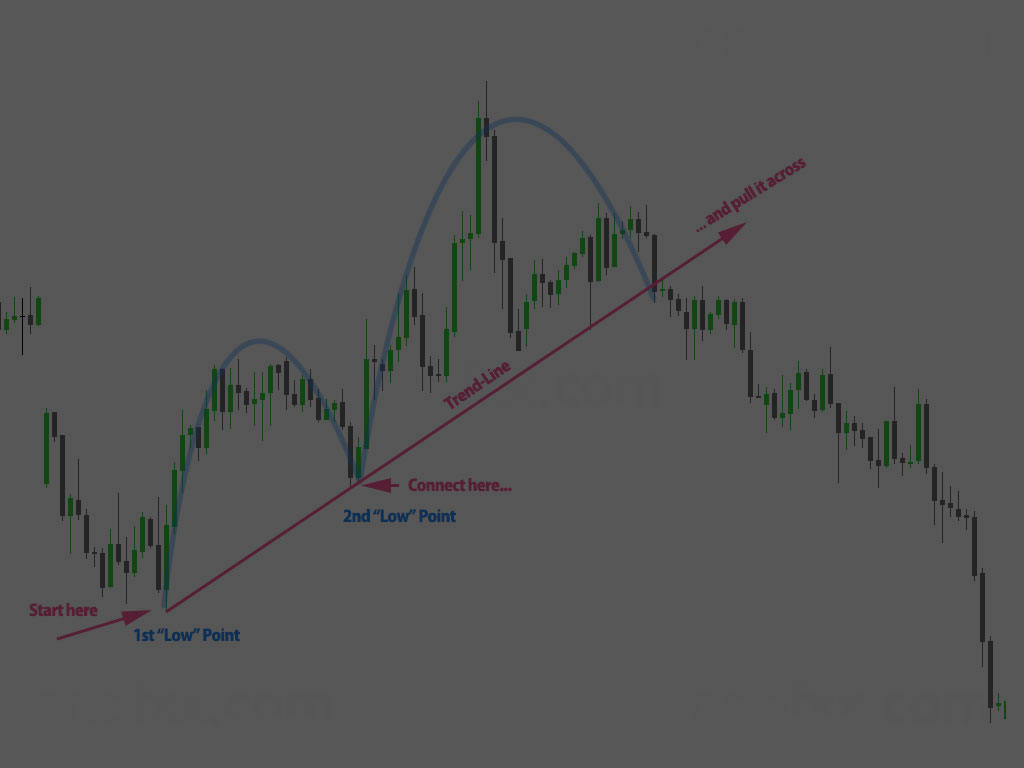

To apply Fibonacci levels to your charts, you must identify a price movement’s significant highs and lows.

Once you have these points, you can use a Fibonacci retracement tool (available in most charting software) to draw lines at the essential Fibonacci percentages. These lines help visualise where support and resistance might occur.

Reading Fibonacci Levels

Imagine looking at a chart and seeing the price heading towards a line you’ve drawn at the 61.8% level. This is a popular level because it’s known as the “Golden Ratio.” If the price pauses or bounces back at this line, it is a good time to consider entering a trade. Traders often seek confirmation from other indicators to make a stronger case for their decisions.

How to Draw Fibonacci Levels on Your Chart

For a Bullish Trend📈

In this example, I draw a Fibonacci Level using the Fibonacci Retracement Tool in MetaTrader4 for a Bullish rally or Upward Move📈.

WTI Daily Bullish Retracement Chart Example

Video GBPUSD – Bullish Fibonacci Retracement Drawing Demonstration

It’s critical to start from the bottom(swing low) to the top(swing high) in the direction of the trend.

As you pull up the tool, you’ll see lines with various measurements appear. These are the Fibonacci levels.

Most default tools have 23.6%, 38.2%, 50%, and 61.8% levels. However, some traders may find adding additional levels helpful, like 0.44% and 75%. Note that these are not standard levels, however you should experiment and find out if they work for you.

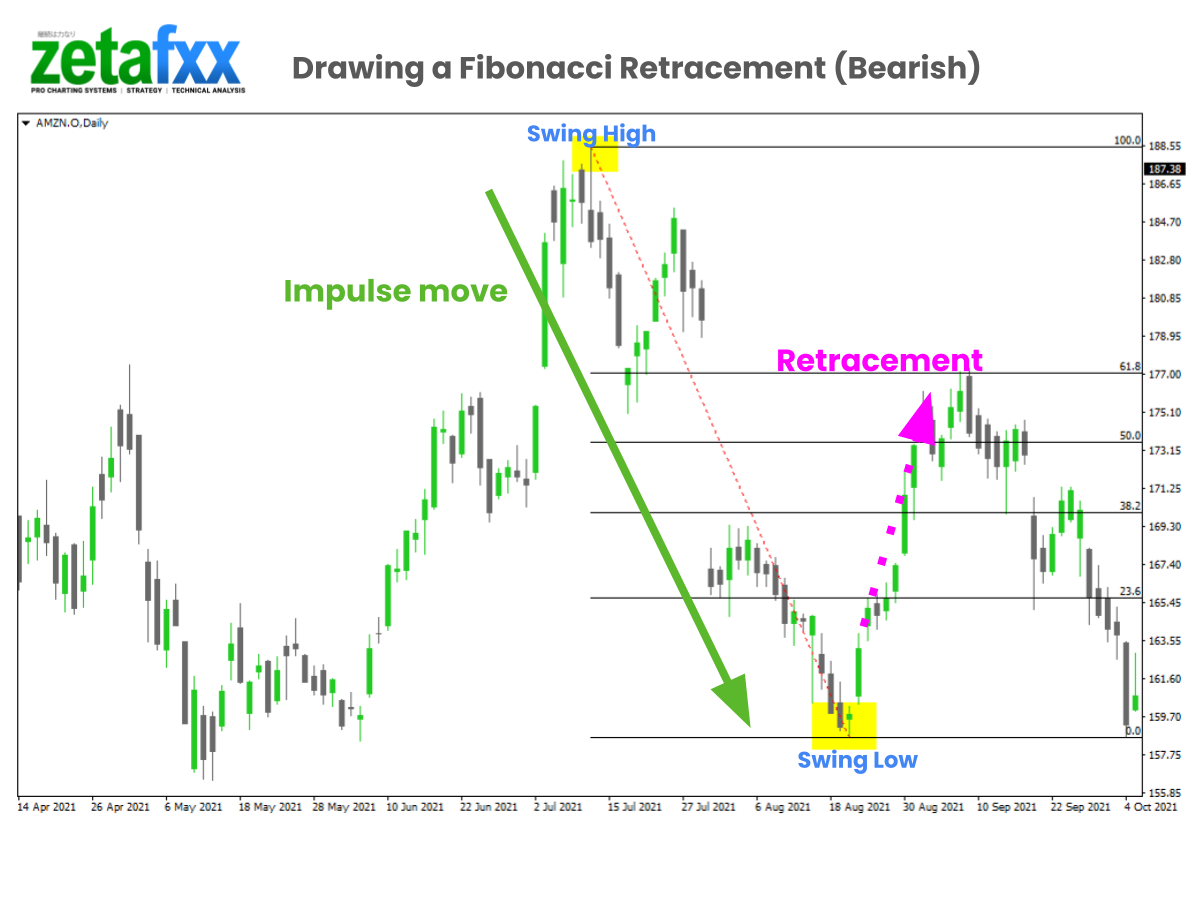

For a Bearish Trend📉

You measure the Fibonacci levels from the TOP(Swing High) to the BOTTOM (Swing Low), in the direction of the trend.

Video – Amazon(AMZN) Bearish Fibonacci Retracement Drawing Demonstration using MetaTrader 4

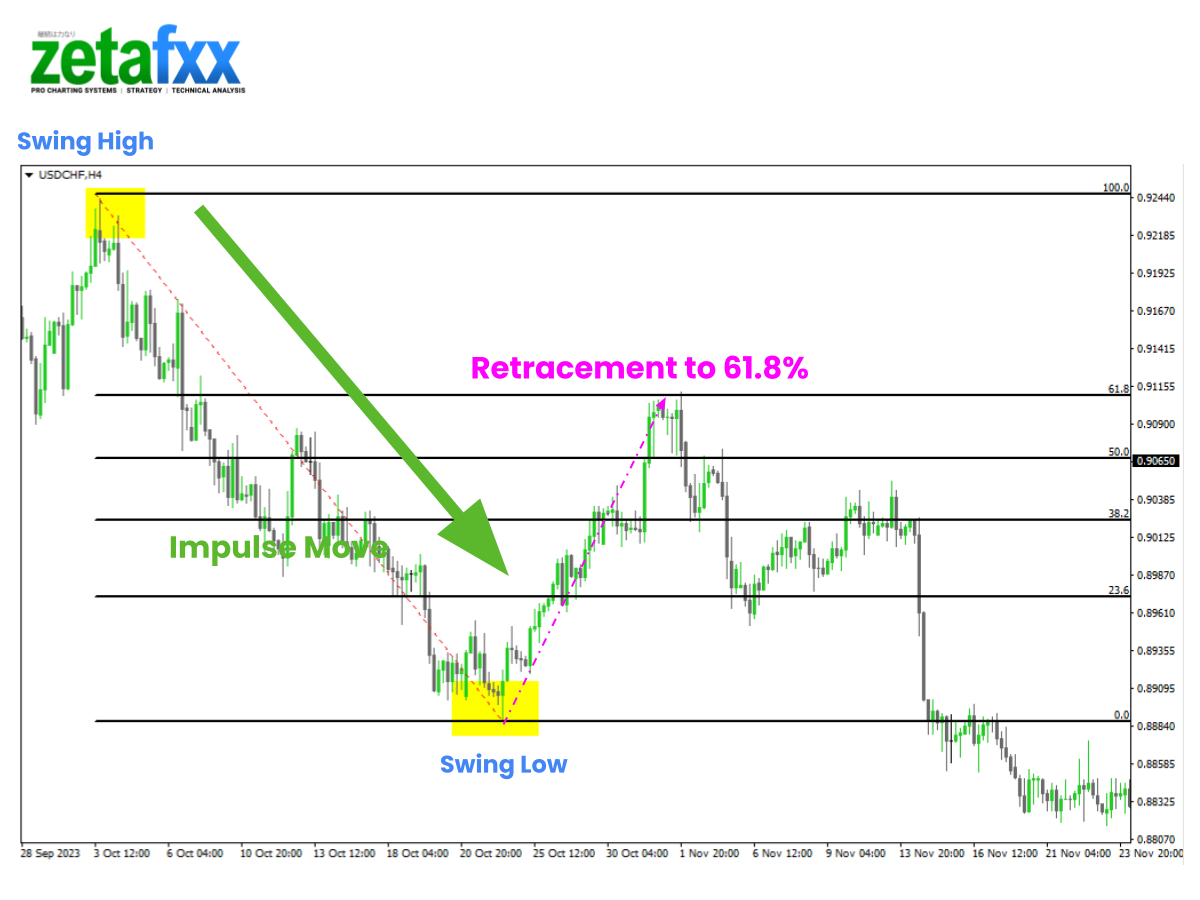

This example shows how the price retraced to 61.8 of the downward move and continued its move down.

Bullish Fibonacci Retracement Examples

Let’s say a stock price dropped from $100 to $50 but then started to climb back up. If it retraces to $61.8 (61.8% of the way back up), that’s a key level to watch for resistance or a potential reversal back down. Conversely, in a bullish scenario, if the price rises from $50 to $100 and then pulls back to $61.8, this could be a support level where the price might bounce back up.

Now, let’s see what this looks like.

Gold – Daily Chart – Bullish Retracement

This is a classic example that shows a bullish retracement to the 61.8 Fibonacci Retracement level before taking off to the upside. Note how the price broke the previous high, signalling a move to the upside.

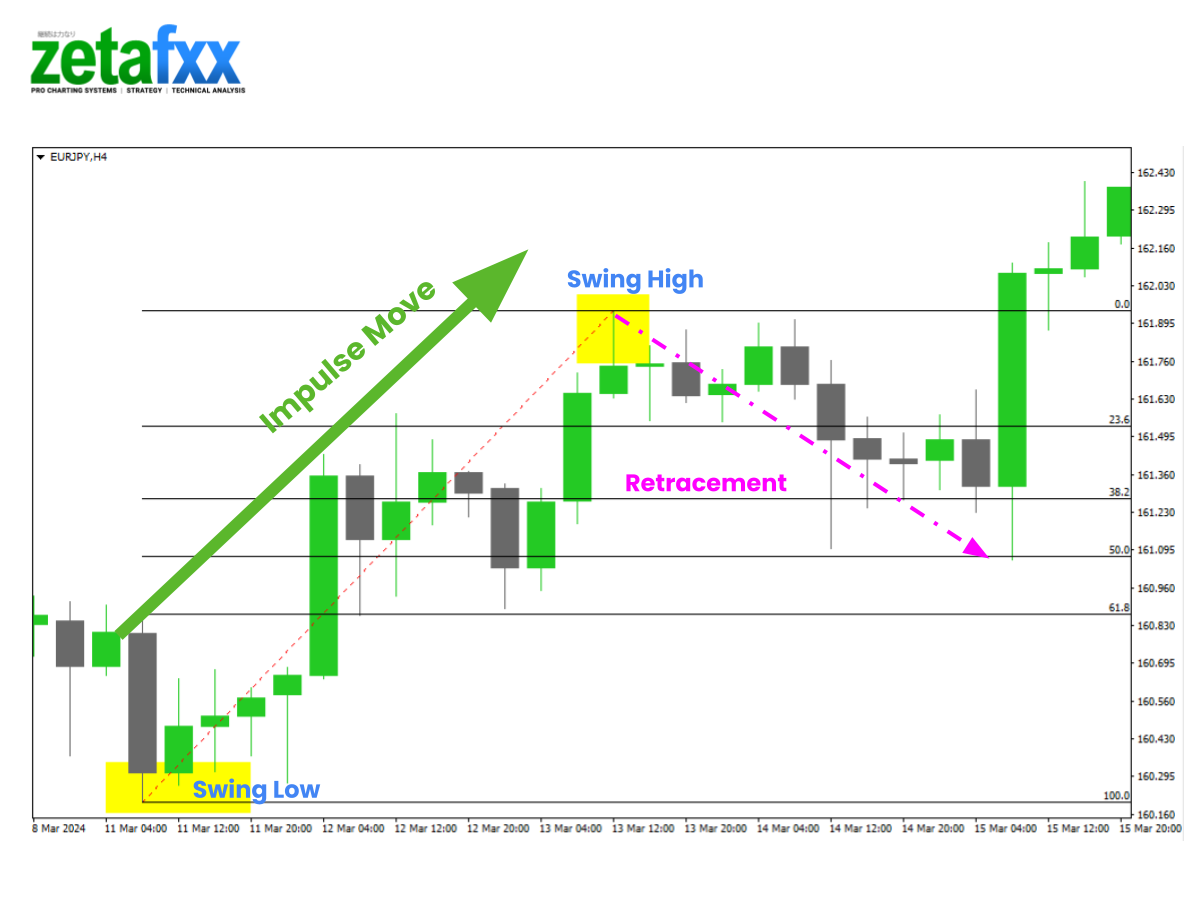

EURJPY – H4 Bullish Retracement Example

EURJPY retraces into the 50% Fibonacci retracement level shortly before taking off to the upside!

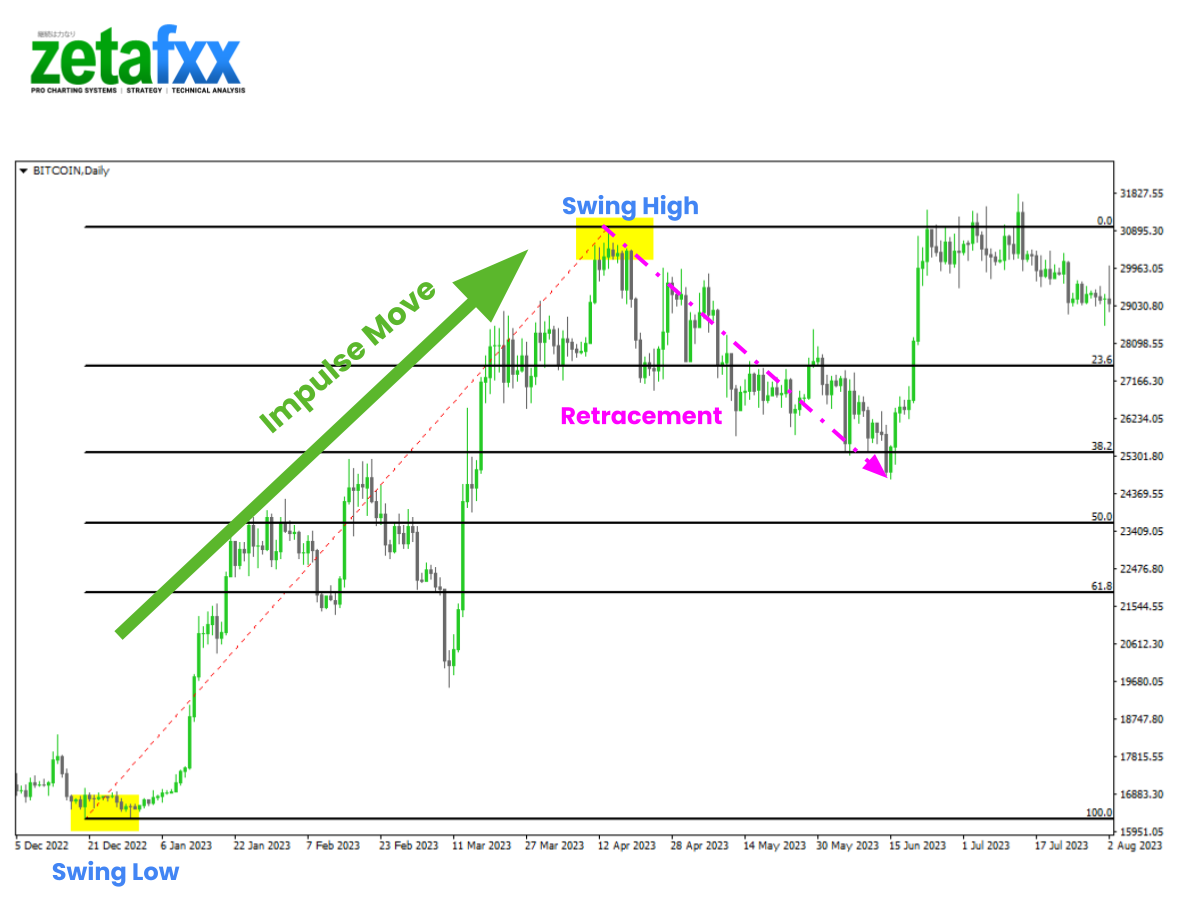

Bitcoin Daily Chart Bullish Fibonacci Retracement Example

This is an example of a price retracing into a 38.2 Fibonacci Level AND having a Support Zone as an additional factor (also known as confluence), resulting in a high-probability move to the upside.

S&P500 Daily Chart Bullish Fibonacci Retracement Example

This example shows the S&P500 retracing into a 61.8 retracement level AND a Support Zone.

Amazon Daily Bullish Fibonacci Chart Example

This example shows Amazon (AMZN) retracing into a 38.2 retracement level AND a Support Zone.

Bearish Fibonacci Retracement Examples

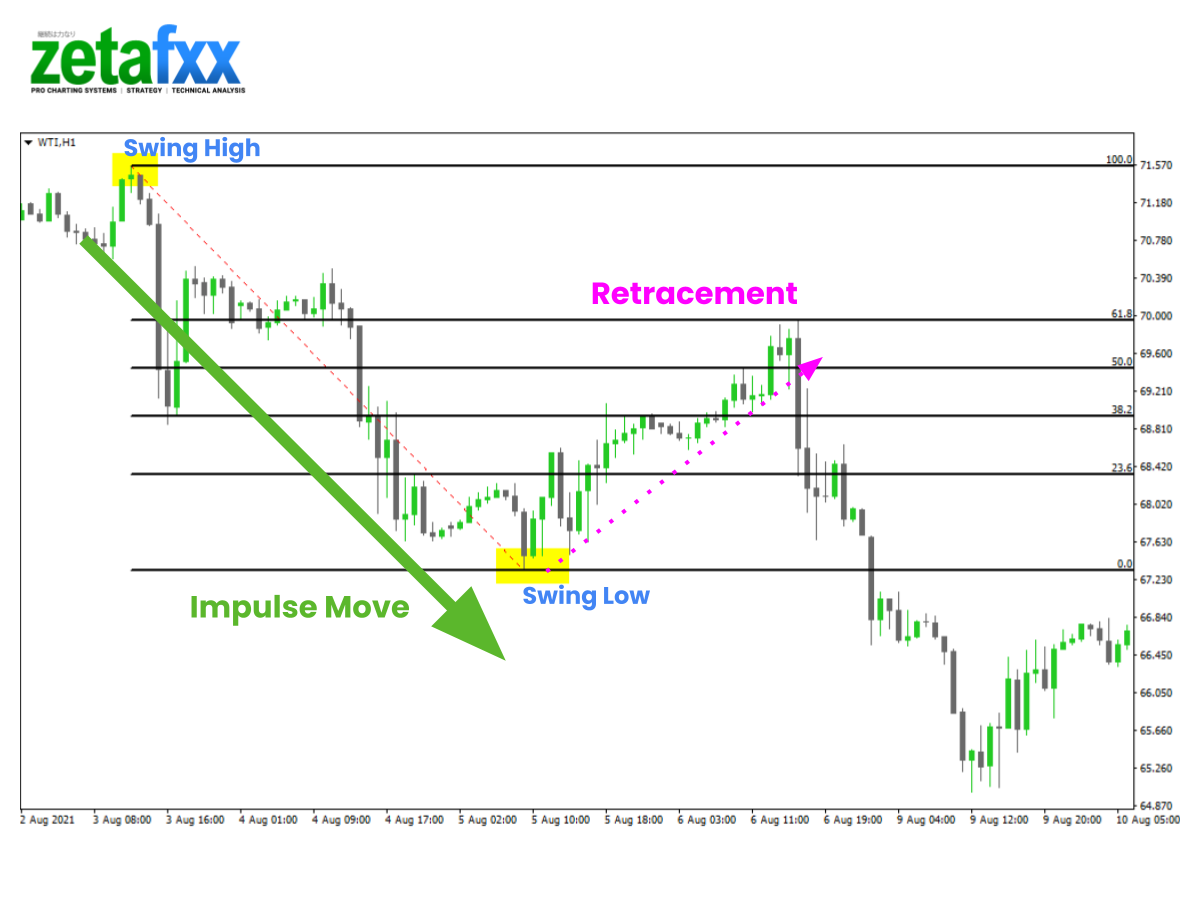

WTI (Oil) H1 Bearish Fibonacci on the hourly chart.

In this example, the price retraced from the swing low to the 61.8 level of the impulse move. You will also see a cluster of prices around the 3rd to 4th of August acting as resistance. With a downtrend on the higher timeframes, price structure, and a Fibonacci level of 61.8, you can see that sellers were quick to sell off at the $70 level mark.

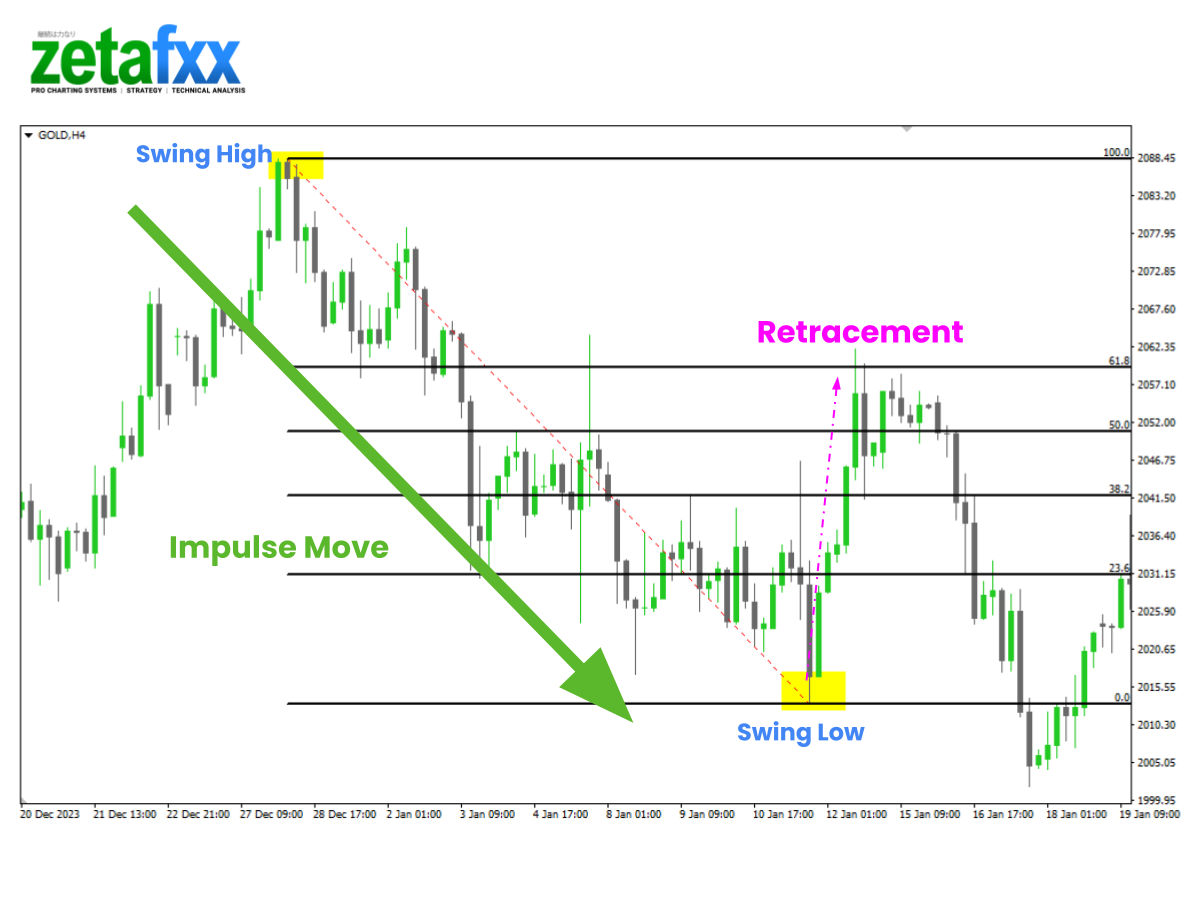

Gold 4-Hourly Bearish Fibonacci Retracement Move

Gold retraced to the 61.8 Level before selling off. You can see a cluster of prices from the 2nd of Jan, forming a resistance zone. Some traders may consider this a good place to start selling with confluence (major downtrend, resistance zone, 61.8 retracement level). You will notice that this is a naturally occurring pattern in your practice.

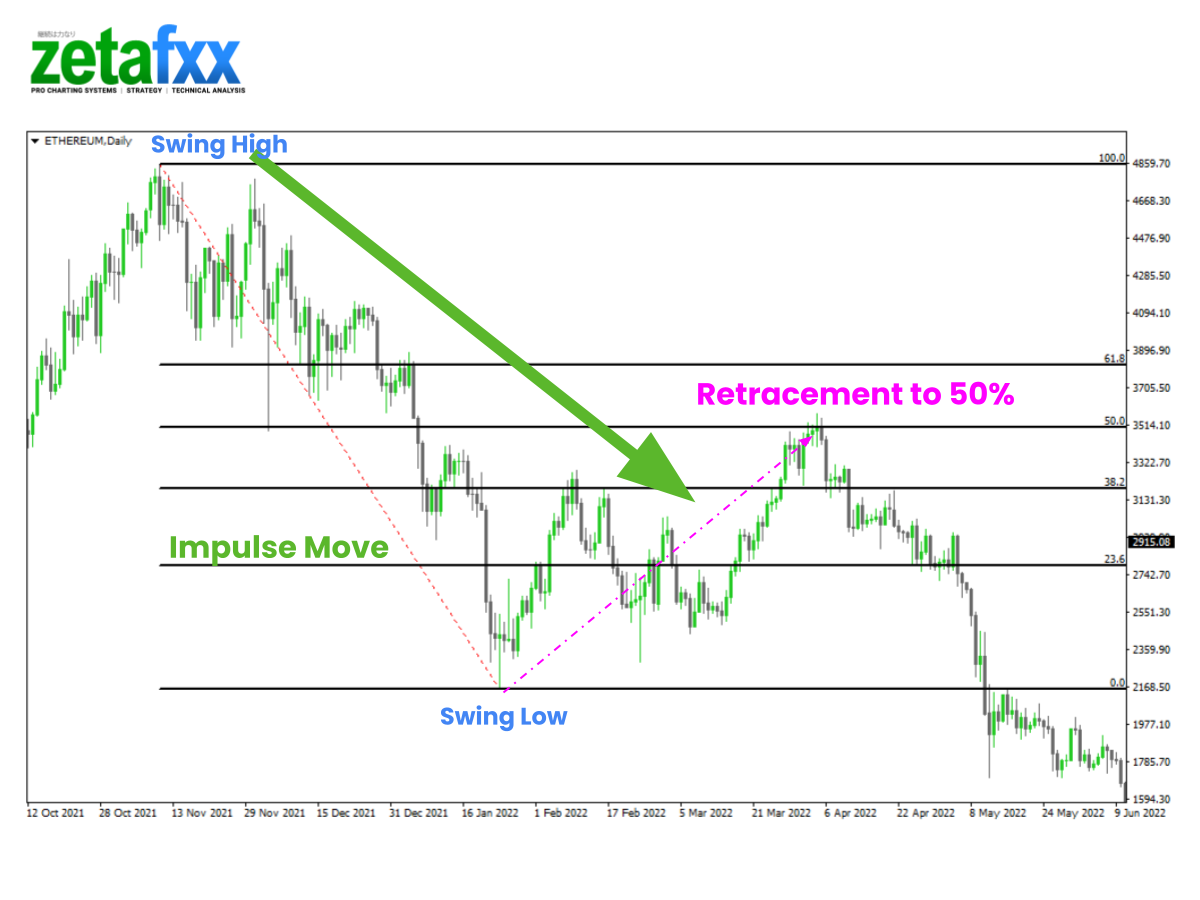

Ethereum Daily Bearish Fibonacci Retracement Move

Even for cryptocurrencies like Ethereum, the retracement behaviour is similar and consistent. However, in this case, the price touched 50% before selling off, continuing its downward move. (Note it didn’t touch the 61.8 level)

USDCHF H4 Bearish Retracement Example

Key Takeaways

- Draw your Fibonacci retracement using the trend direction.

- For a Bullish Retracement📈, you must draw from the lowest to the highest swing point.

- For a Bearish Retracement📉, you must draw from the highest to the lowest swing point.

- The ‘ideal’ Golden Zone is 50~61.8%; however, this must be supported by other trading factors such as a support or resistance zone.

You’ll notice in the examples above that the Fibonacci levels are usually not used independently.

You’ll read on many sites that the ‘Golden Ratio’ is at the 61.8 level, and you’ll find that most people repeat this. However, people draw different swing points, and it is subjective. Sometimes, you will see that price will just punch through all Fibonacci Levels and structures—it’s not definite, and you have to remember that we are working with probabilities. That’s the name of the game!

I’ve found that the larger timeframes work best.

Start your practice by drawing Fibonacci levels on the Weekly and Daily timeframes.

Fibonacci Retracement Success Factors

As the above examples show, some common patterns result in repeatable positive outcomes.

Let me show you some examples which should help you spot them better. I’ll use line drawings so you get to visualise the use of the patterns.

These factors are…

- Large Swing Point Distance

- Support, Support, Support (in a Bullish Trend)

- Be part of a Larger Uptrend.

1. Large Swing Point Distance and a Higher Timeframe

Make sure you use LARGE swing points between them! The larger the distance, the stronger these levels tend to be, as investors, institutions and banks tend to pay attention more closely.

If you’re new to trading or using the Fibonacci Levels, start with the 4-H timeframe and higher.

While Chart patterns are fractal (meaning patterns repeat themselves on the smaller timeframe, down to the 1 min charts), starting with a higher timeframe and being subjected less to noise in the 1m to 30 min timeframes is easier.

Once you’ve attained a better understanding and experience with the higher timeframes, you can gradually move to smaller timeframes if you’re day trading or scalping.

2. Support, Support, Support!

- Always see if there’s a cluster of prices or a clear support zone.

3. Be part of a major Uptrend

Being part of a more significant uptrend will help your Fibonacci retracement trades. As long you follow the trend, you will also be aligned with where market forces (and other traders) are going.

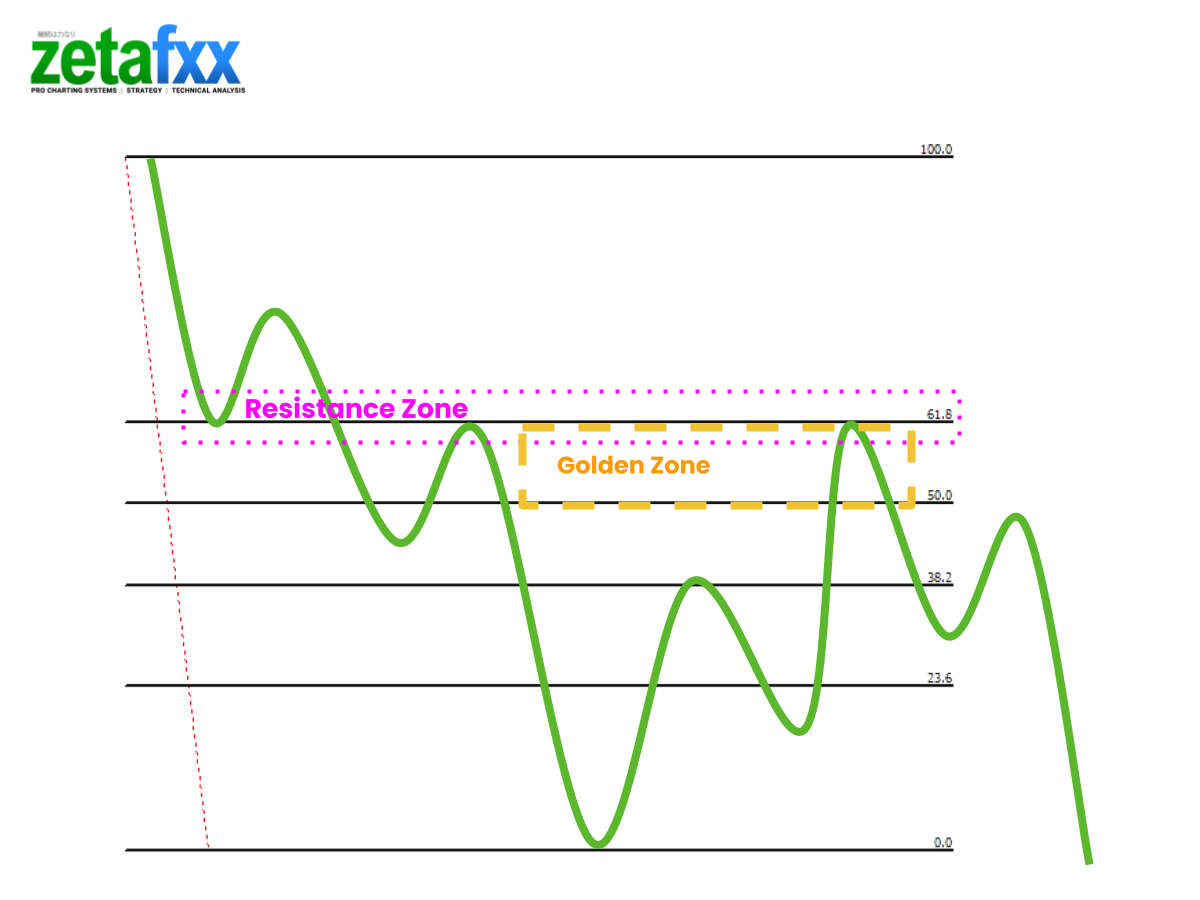

Bearish Fibonacci Factors

Here’s an example of a bearish move to the downside.

Use a Large Swing Point Distance and a Higher Timeframe for Bearish Moves

Resistance zones will tend to halt and U-turn prices, with other factors involved

Always try to combine a cluster of prices in the past (that forms a resistance zone) with price in the ‘Golden’ retracement zone (between 50%~618%).

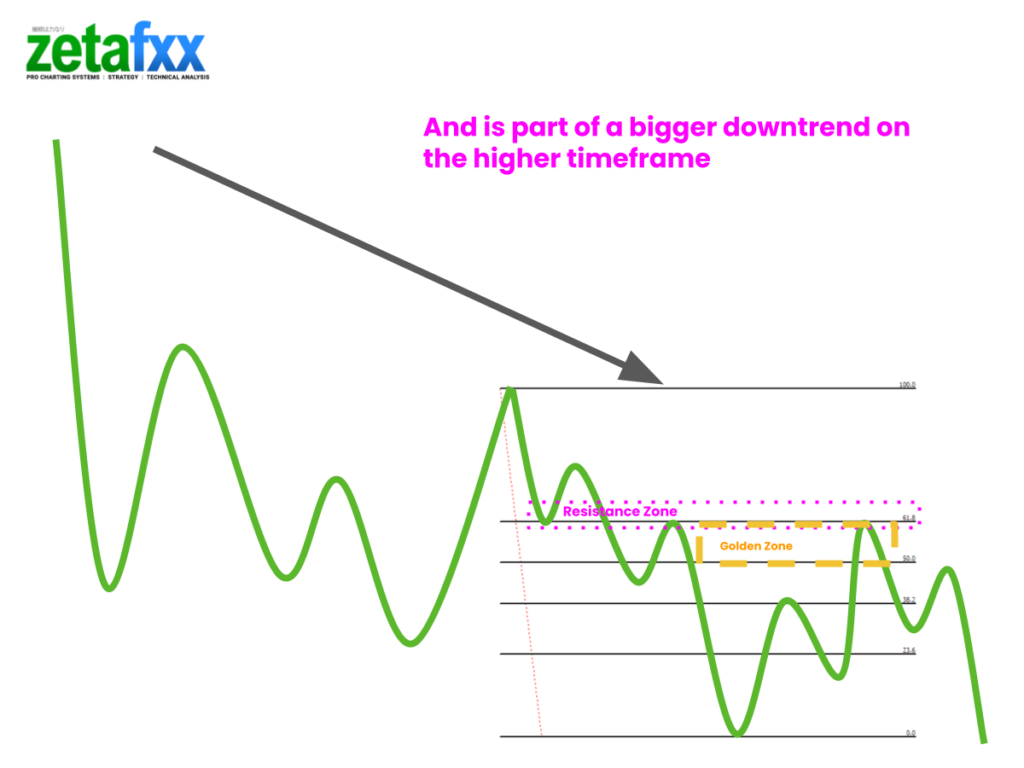

Use the more significant downtrend to help you.

Follow the trend, as the great masters would say – you significantly increase your odds of success when you’re in the larger downtrend.

Mix these (Major Downtrend + Resistance Zone + Golden Fibonacci Retracement zone) for the best results.

Trading Setups

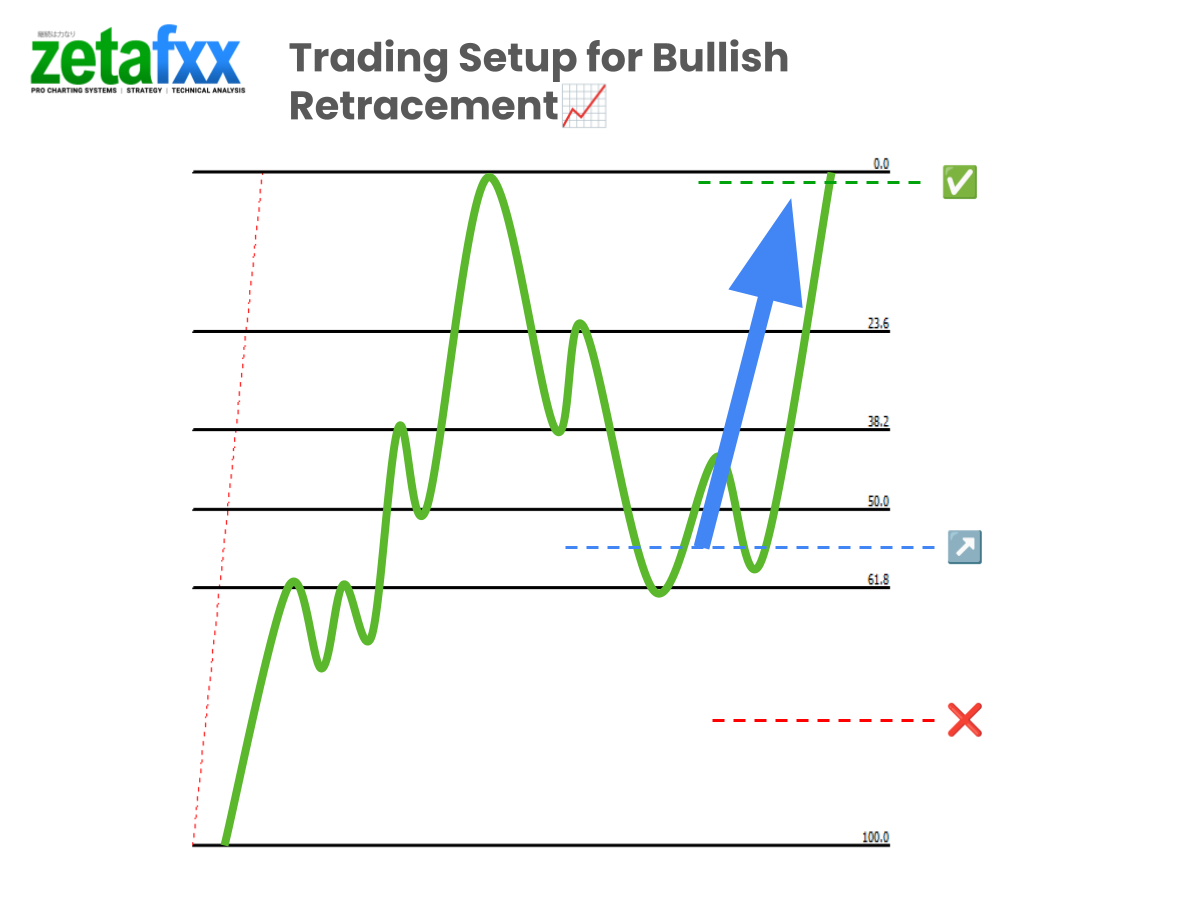

Bullish Retracement Trades

For a Bullish Retracement setup, I typically set my Stop Loss below the swing low of the Fibonacci measurement. This allows the price to move and ‘breathe’ without stopping me out too early.

Glossary:

✅ Take Profit – where you would close your buy position

↗️ Buy Entry Price – your buy position entry

❌Stop Loss – where you would close the trade in a loss

The Take profit level would typically be at the next major resistance level; at times, I may also choose to close my buy trade before major news or close it partially.

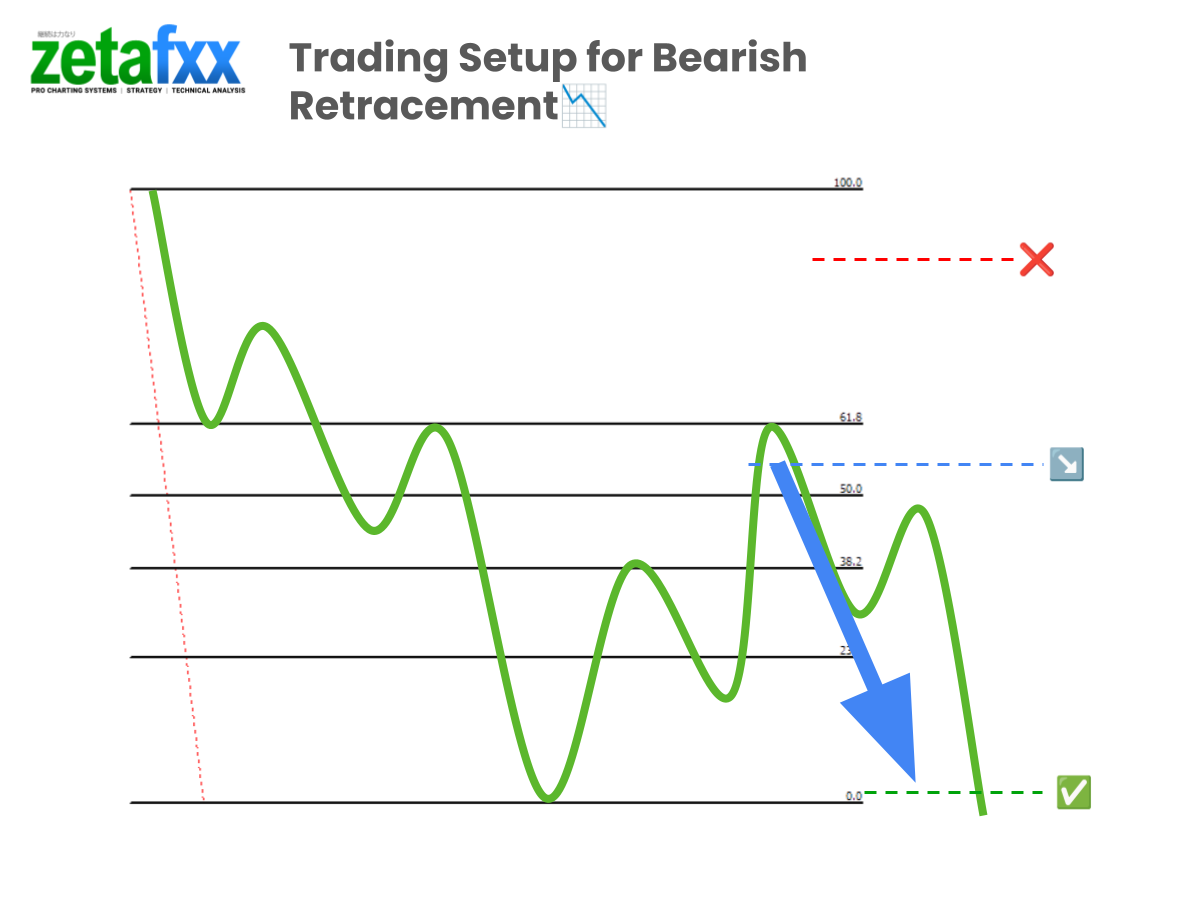

Bearish Retracement Trades

Like the Bullish retracement setup, the bearish setup is the inverse. I would set my Stop Loss above the resistance zone and Fibonacci level.

Glossary:

❌Stop Loss – where you would close the trade in a loss

↘️ Sell Entry Price – your sell position entry

✅ Take Profit – where you would close your sell position and take profit.

I would often look for a candle close below the Fibonacci level as a sort of ‘confirmation’ prior to taking the trade.

Fibonacci Levels are very subjective.

Now that you understand the general concept of using Fibonacci levels to help with your trading, you must know that they are VERY SUBJECTIVE.

The ‘Golden’ ratio zone (i.e. between 50%-61.8% retracement levels) is not guaranteed.

In reality, I wished prices would always bounce at 61.8%, but they don’t always do that.

You will often find that prices retrace to the 23.6 levels before continuing upwards—and at other times, they may retrace past 75% and even past your lowest swing point.

Again, it’s just probabilities. Ideal setups don’t always appear, but you will learn to look for them and get some experience by drawing more retracements and seeing the patterns repeat themselves.

Use a mental scorecard to add to your probability of success!

Whenever you draw a Fibonacci retracement, you’re just seeking another reason that this is a good trade.

Why?

A group of traders uses these levels to buy in. Each technical reason/factor means you’re grouping more and more traders to ‘support’ your decision.

Let’s assume you’re in a bullish market. You’re drawing a Fibonacci retracement and notice that the price is at the 50% or even 61.8% retracement zone. Your heart starts to race, and your mind tells you it’s the right place to buy, but there’s no price structure in the past to ‘confirm’ that it’s a good trade to take.

Before you open a buy position, stop.

Tell yourself that it’s just a factor that provides you an additional 10% (out of 100%) that this is potentially a good place to take a trade from.

You want to add more factors as you analyse your charts and how it looks like it will be something like this.

Daily Uptrend? Yes. (10%)

Fibonacci Retracement ‘Golden’ Zone? Yes. (+10%)

Support Zone? Yes. (+10%)

Breakout Buy Setup? Yes. (+10%)

Bullish Confirmation candle? Yes. (+10%)

And you’ll notice that your above score adds up to 50% probability.

Your trading plan, which consists of your position size (+5%), stop loss (+5%), and take profit(+5%) levels and Risk-to-reward ratio (+15%), will add another 30%.

In most cases, I need a mental score of 70% or more before I take and execute a position.

Conclusion

Fibonacci trading is both an art and a science. It harnesses the power of numbers to give traders insights into market trends and potential reversals. Remember, while Fibonacci can provide valuable guidance, using it alongside other tools and analysis methods to validate your trading decision is essential.

Useful Resources

To gain familiarity, practice thoroughly without risk by practising at least 50 Fibonacci retracement setups for bullish and bearish scenarios.

You can use free charts on the following platforms to try out first.

Backtesting for Strategy Refinement

Once you’re comfortable with the breakout strategy, we highly recommend using a backtesting simulator like Forex Tester to fine-tune your approach.

Forex Tester is a great tool for testing your strategies in a risk-free environment. It uses extensive historical data to simulate real market conditions, helping you identify strengths and weaknesses. This allows you to adjust your strategy without risking real money. Forex Tester enhances your learning curve and builds confidence, making it invaluable for beginners and experienced traders.

Forex Tester Features:

- Realistic Simulation: Mimics real market conditions using historical data.

- Extensive Historical Data: Access years of historical data to test different scenarios.

- Advanced Charting Tools: Utilize trendlines, indicators, and drawing tools for detailed analysis.

- Customizable Strategies: Create, test, and refine your trading strategies.

- Detailed Reporting: Generates comprehensive performance reports to identify strengths and weaknesses.

Benefits of Using Forex Tester:

- Risk-Free Practice: Perfect for refining strategies without risking real capital.

- Improved Strategy Development: Thorough backtesting helps understand strategy performance in various market conditions.

- Accelerated Learning Curve: Provides a controlled environment in which to learn and practice trading.

- Time Efficiency: Compress years of market data into a shorter period for quick, long-term strategy testing.

- Performance Analysis: Offers detailed metrics and reports to evaluate and improve strategies.

Final Thoughts

Mastering the Fibonacci retracement strategy requires dedication and practice. Tools like Forex Tester allow you to practice risk-free, refine your techniques, and build confidence before trading with real capital.

Combining theoretical knowledge with practical application through backtesting is crucial for developing a robust trading strategy. Stay committed, keep learning, and use these resources to enhance your trading journey. Success in trading comes with persistence, practice, and a willingness to learn from successes and mistakes. Happy trading!